r quantmod|r calculate quantiles : trade Chapter 7. Quantmod. Quantmod stands for quantitative financial modelling framework’’. It has three main functions: download data, charting, and. technical indicator. Then we can conduct .

Resultado da Sinopse: Baixar Nefarious Torrent (2023) Dublado e Legendado - Magnet Link Download. No dia de sua execução, um assassino em série passa .

{plog:ftitle_list}

WEB10 de set. de 2023 · African Grand Online Casino is a spot-on gaming website that will bring you the best of the iGaming world. You will have the opportunity to enjoy yourself a big deal and have a blast picking from the available slots. Get yourself going with a neat bonus right from the start that grants you 25 free spins!

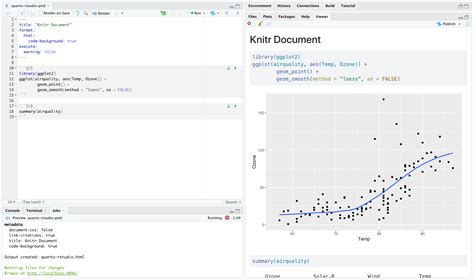

rstudio quarto document

quantmod: Quantitative Financial Modelling Framework. Specify, build, trade, and analyse quantitative financial trading strategies. Version: 0.4.26. Depends: R (≥ 3.2.0), xts (≥ 0.9-0), .

News - CRAN: Package quantmod - The Comprehensive R Archive NetworkTTR - CRAN: Package quantmod - The Comprehensive R Archive NetworkRMySQL - CRAN: Package quantmod - The Comprehensive R Archive Network

Kjeldahl Apparatus purchase

r quantmod package

The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models.

Chapter 7. Quantmod. Quantmod stands for quantitative financial modelling framework’’. It has three main functions: download data, charting, and. technical indicator. Then we can conduct .quantmod is an R package that provides a framework for quantitative financial modeling and trading. It provides a rapid prototyping environment that makes modeling easier by removing the repetitive workflow issues surrounding data .Functions in quantmod (0.4.26) addROC. Add Rate Of Change to Chart. addSMI. Add Stochastic Momentum Indicator to Chart. chobTA-class. A Technical Analysis Chart Object. addSAR. Add .When building models in R, often a formula is passed to the fitting function along with the appropriate data object to search. To handle many different sources it is necessary to either create a data object with all the columns prespecified, OR .

Users should download the most stable version of quantmod from CRAN or startup R and type: > install.packages ('quantmod') which will install the required packages: xts, for internal data .

Introduction to Quantmod in R. The quantmod package for R is designed to assist the quantitative traders in the development, testing, and deployment of statistics based trading models. Using quantmod, quant traders can quickly explore and .The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models. What quantmod IS. A rapid . quantmod: Quantitative Financial Modelling Framework. Specify, build, trade, and analyse quantitative financial trading strategies.

S&P500構成銘柄中、2022年11月の平均日次収益率が最も高かったのはEtsyであったことがわかります。. おわりに. 以上、{quantmod}パッケージを用いた株価情報の取得方法について紹介しました。 Rではデータフ .An R package to manage the quantitative financial modelling workflow. quantmod Quantitative Financial Modelling . The first is simply an intro to some of what quantmod has to offer, the second covers all the current quantmod and xts tools for dealing with data. Many of the former now have found a new home in the latter.Specify, build, trade, and analyse quantitative financial trading strategies.

Digital Automatic Polarimeter purchase

Datasets: Many R packages include built-in datasets that you can use to familiarize yourself with their functionalities. To identify built-in datasets. To identify the datasets for the quantmod package, visit our database of R datasets.; Vignettes: R vignettes are documents that include examples for using a package. To view the list of available vignettes for the quantmod .

Rで株価データを取り扱うに当たって、quantmodパッケージはとても便利なので紹介しておきます。ぶっちゃけ備忘録も兼ねてます。 まずこのパッケージの何がすごいのかというと,xts形式の株価データが簡単に取得できるとともに金融関係の関数を豊富に取り揃えており、かつplot関数なんて比じゃ .

An R package to manage the quantitative financial modelling workflow. quantmod Quantitative Financial Modelling . One of the newest and most exciting additions to the recent quantmod release includes two new charting tools designed to make adding custom indicators far quicker than previously possible.

The quantmod package for R is designed to assist the quantitative traders in the development, testing, and deployment of statistics based trading models.Using quantmod, quant traders can quickly explore and build trading models. The important features of quantmod that we will use are divided into three categories: 1) downloading data, 2) charting, and 3) technical indicators and . Help page Topics; Quantitative Financial Modelling Framework: quantmod-package quantmod quantmodenv: Add Directional Movement Index: addADX: Add Bollinger Bands to Chart “The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models.” It is a rapid prototyping environment where enthusiasts can explore various technical indicators with minimum effort. It offers charting facilities that is not available elsewhere in R. Quantmod package .Details. A convenience wrapper to getSymbols(x,src='oanda').See getSymbols and getSymbls.oanda for more detail. Value. The results of the call will be the data will be assigned automatically to the environment specified (global by default).

Quantmod简介. Quantitative Financial Modelling & Trading Framework for R. 译:R的定量金融建模和交易框架 {quantmod} The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models.. 译:R语言的quantmod包是为协助定量交易员开发、测试和部署以统计为基础的交易 .Overview of the Quantmod R package to retrieve stock data and display charts. Video cover basic commands in the Quantmod package that can be used to pull fi.

Details. periodReturn is the underlying function for wrappers: . allReturns: calculate all available return periods dailyReturn: calculate daily returns weeklyReturn: calculate weekly returns monthlyReturn: calculate monthly returns quarterlyReturn: calculate quarterly returns annualReturn: calculate annual returns Value. Returns object of the class that was originally . 安裝quantmod. 從上方工具列的Tools>Install Package打開如上圖,在Package輸入quantmod,按右下角的Install即可。 或是輸入install.packages(“quantmod”)也可以。 如果有要選擇地區則選Taiwan(Taipei)。 步驟2:繪製K線圖以及均線圖We would like to show you a description here but the site won’t allow us.

The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models. What quantmod IS. A rapid prototyping environment, where quant traders can quickly .An R package to manage the quantitative financial modelling workflow. quantmod Quantitative Financial Modelling . The first is simply an intro to some of what quantmod has to offer, the second covers all the current quantmod and xts tools for dealing with data. Many of the former now have found a new home in the latter.Quantmod程序包介绍:其目的在于为量化交易者提供一个进行建模的平台,目前的主要功能是获取交易数据进行处理并绘制交易图形。最主要的函数有:ETL类函数、分析类函数、展现类函数。 本文利用Quantmod程序包进行以. “The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models.”. It is a rapid prototyping environment where enthusiasts can explore various technical indicators with minimum effort. It offers charting facilities that are not available elsewhere in R. Quantmod package .

Try it yourself gettingdata.R. Charting with quantmod. Now that we have some data we may want to look at it. Enter the new function chartSeries. At present this is a nice tool to visualize financial time series in a way that many practicioners are familiar with - line charts, as well as OHLC bar and candle charts. .The quantmod package for R is designed to assist the quantitative trader in the development, testing, and deployment of statistically based trading models. What quantmod IS. A rapid prototyping environment, with comprehensive tools for data management and visualization. where quant traders can quickly and cleanly explore and build trading models.

Functions to load and manage Symbols in specified environment. Used by specifyModel to retrieve symbols specified in first step of modelling procedure. Not a true S3 method, but methods for different data sources follow an S3-like naming convention. Additional methods can be added by simply adhering to the convention.

Current src methods available .

We would like to show you a description here but the site won’t allow us.Bollinger Bands Strategy. The idea of this strategy is. Definition: A Bollinger Band consists of 3 lines. A simple moving average (SMA) and two additional lines plotted 2 standard deviations above and below the SMA.

Become an expert in R — Interactive courses, Cheat Sheets, certificates and more! Get Started for Free. Dismiss. Documentation. R. quantmod. quantmod. Quantitative Financial Modelling Framework. Specify, build, trade, and analyse quantitative financial trading strategies. Functions (67) Defaults. Manage Default Argument Values for quantmod .

Download Federal Reserve Economic Data - FRED(R) Description. R access to over 11,000 data series accessible via the St. Louis Federal Reserve Bank's FRED system. Downloads Symbols to specified env from ‘research.stlouisfed.org’. This method is not to be called directly, instead a call to getSymbols(Symbols,src='FRED') will in turn call .An R package to manage the quantitative financial modelling workflow. examples :: data} Now that we've taken an overall look at how data can be handled in quantmod it may be time to examine some of the more useful tools in a bit more detail. [Note: much of the strictly time-based functionality of quantmod has been moved to the new xts package developed by Jeff Ryan .

r quantmod getsymbols

Treasures of Troy Slots is a video slots game developed by International Gaming Technology (IGT). IGT is known around the world for being one of the . Ver mais

r quantmod|r calculate quantiles